Renters Insurance in and around Mankato

Your renters insurance search is over, Mankato

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or property, renters insurance can be the right next step to protect your personal property, including your bicycle, tools, children's toys, sports equipment, and more.

Your renters insurance search is over, Mankato

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps safeguard your personal possessions in case of the unexpected.

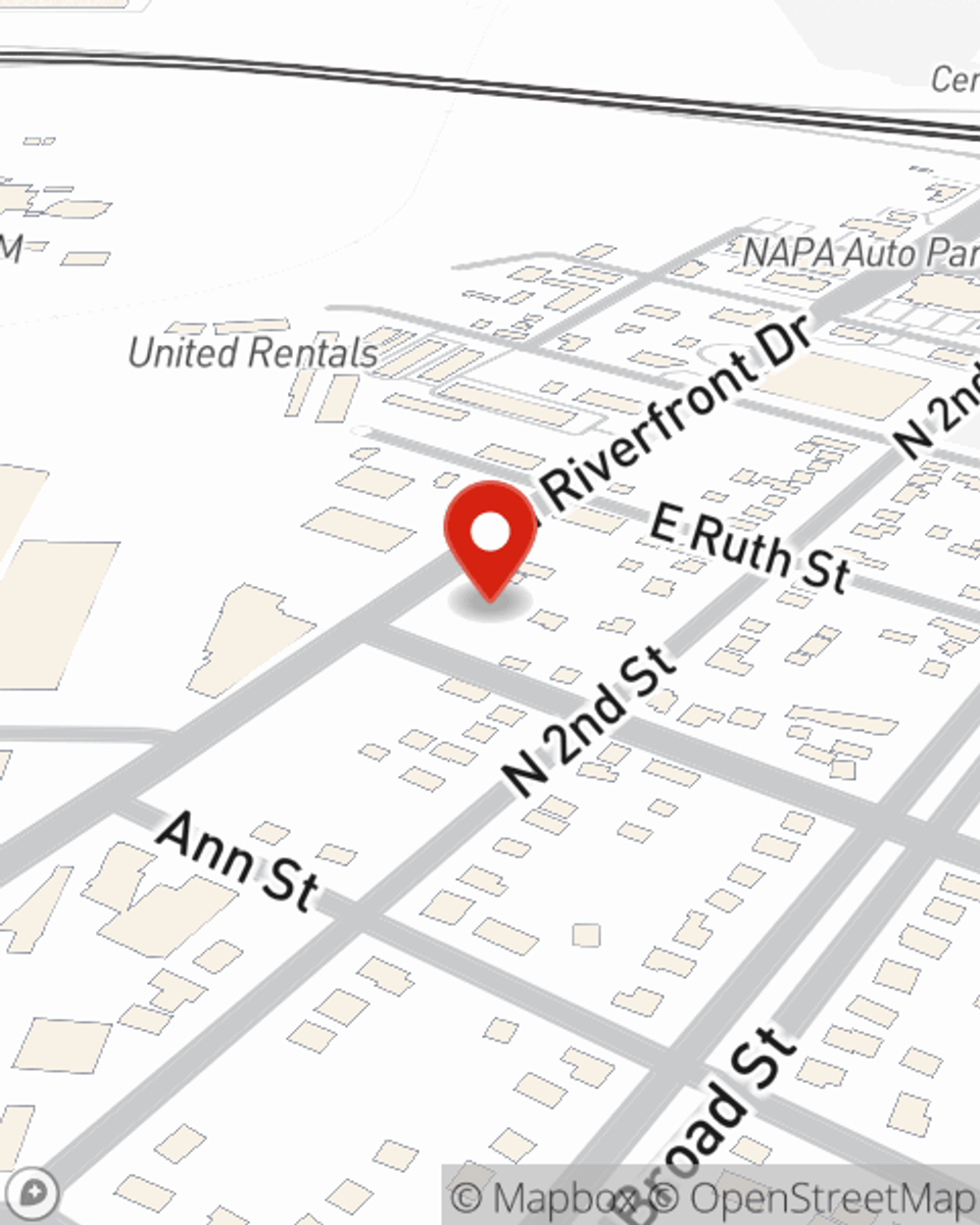

More renters choose State Farm® for their renters insurance over any other insurer. Mankato renters, are you ready to see how helpful renters insurance can be? Call or email State Farm Agent Aaron Hatanpa today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Aaron at (507) 345-3606 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Aaron Hatanpa

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.